What is Corporate Performance Management All About?

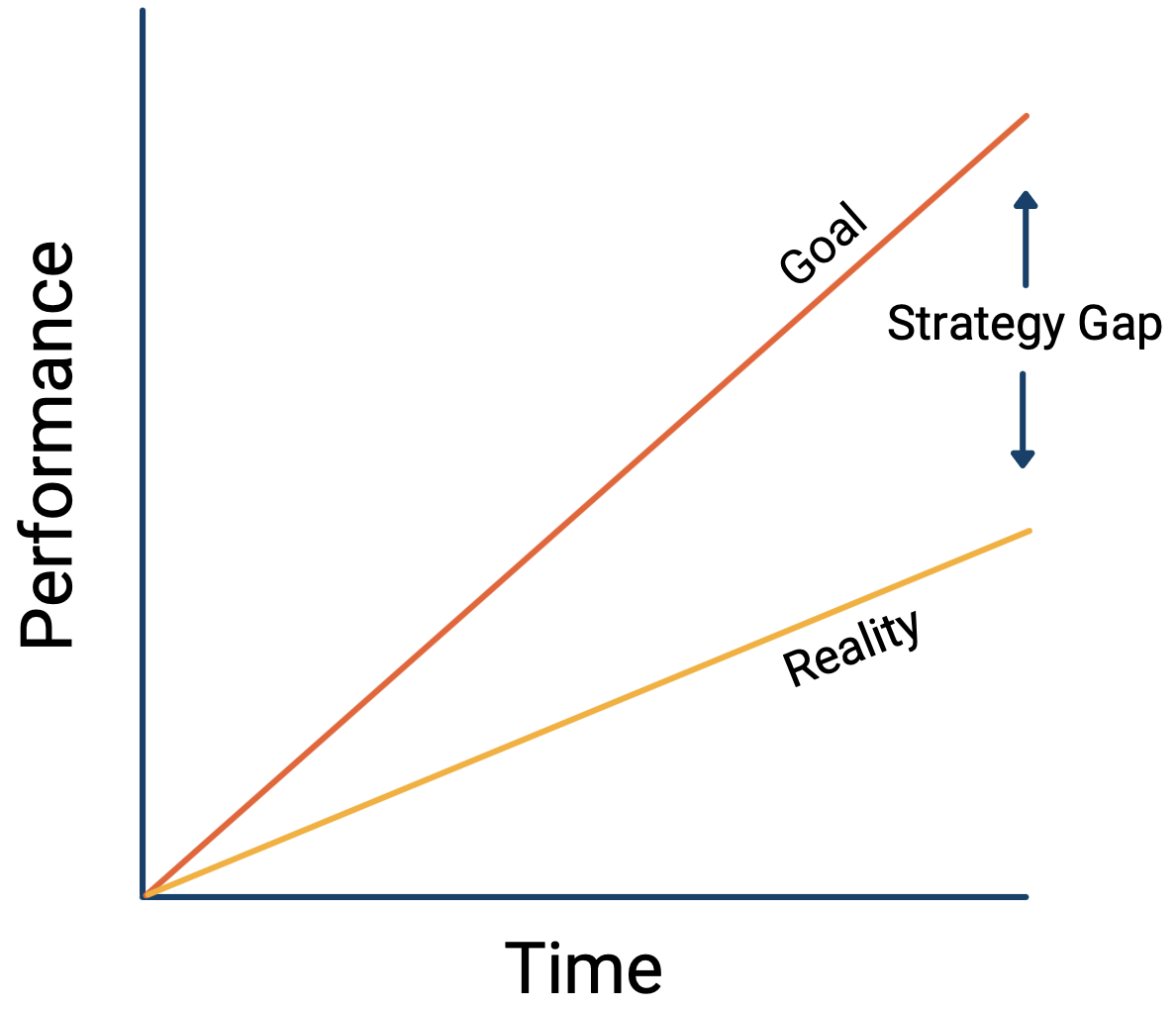

Corporate Performance Management, as a discipline, addresses a company’s gap between what they want to do and what they can do.

There is a common tendency for any conversation around Corporate Performance Management (CPM) to become a software selection debate.

“Have you seen what our platform is capable of?”

“Our platform is the only one that has ABC functionality, something you absolutely need.”

“Oh, I’ll never work with XYZ again, they were so horrible at my last job.”

These conversations quickly devolve into a comparison of features or banter about positive and negative experiences with each platform.

What is missing from these conversations is a genuine discussion about why using a particular tool even matters. Are these software solutions merely to improve the quality of life for a given team or do they serve a more strategic purpose?

WHAT IS CORPORATE PERFORMANCE MANAGEMENT?

Before we answer questions about the role of software, let’s establish what CPM is trying to accomplish.

Corporate Performance Management, as a discipline, addresses a company’s gap between what they want to do and what they can do.

This gap, known as the strategy gap, keeps your company from where it wants to be and bridging it is the challenge of every organization that has performance ambitions.

Though strategy is typically the purview of executive leadership, it’s your finance team that has the comprehensive view necessary to figure out what drivers are responsible for your strategy gap. Through diligent business partnering, the finance team can help close the gap and make those lofty strategic goals a reality. After all, strategic initiatives won’t succeed unless they are properly funded and measured.

THE PERFORMANCE MANAGEMENT CYCLE

Once a company has determined its strategy, it must attempt to translate that strategy into actionable steps to achieve the desired performance. To manage company performance, an organization performs the following cyclical set of steps:

Determine key performance indicators and drivers

Set goals that affect your key drivers

Adjust behavior and execute against those goals

Evaluate results against key performance indicators

To help with this process, clients will turn to any of the CPM platforms to support the above management process. When your organization considers implementing a new system, you aren’t just thinking about buying some IT software that automates work; instead, you are considering a holistic platform customized to facilitate your execution of the performance management cycle within the context of your specific business requirements.

Consider this: A company wants to grow its revenue by 30%. With a properly designed and built financial model (and by extension the system that holds the model) you can:

Model the impacts decisions have on your key drivers. “What happens if we hire 10 new salespeople in Q3?”; “If our new marketing campaign targets this demographic, what are our potential customer population scenarios?”; “Will buying this new equipment increase our inventory?”

Set your goals. Determine whether you need to increase the size of your sales team, up your marketing spend, or invest in your manufacturing capacity.

Plan your business activities and set your budget against the activities and goals. Forecast the outcome(s) if you perform your modeled activities.

Compare your budgeted activities against your actual results. See if you successfully affected your drivers and whether that brought you closer to your goals.

Remember, Marketing will tell you that an investment in a new campaign will increase the number of potential buyers. Sales will tell you that you need more agents in the field. Ops will tell you that you need to upgrade your manufacturing capabilities. These might all be true, but without a finance person in the room, these will remain experiential assumptions rather than measured fact. A properly built financial model can provide the return on investment for each of these activities and help you determine exactly what to do and how much to do it.